Table of Contents

What is Customer Acquisition Cost (CAC)?

Customer Acquisition Cost (CAC) is the cost of acquiring a new customer. In other words, CAC refers to the resources and costs involved in obtaining an additional customer. Customer acquisition cost is a key business metric commonly used along with the Customer Lifetime Value (LTV) metric to measure the value generated by a new customer.

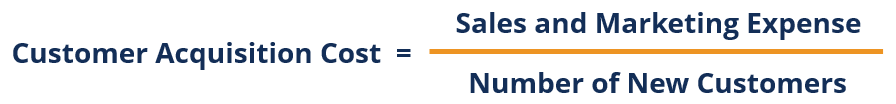

Formula to calculate Customer Acquisition Cost (CAC)

Customer acquisition cost is the best estimate of the total cost of acquiring a new customer. It should generally include Advertising costs, your advertiser’s salaries, your seller’s costs, etc., divided by the number of customers received.

Principle for calculating CAC:

CAC = (Total cost of sales and marketing) / (# Customers received)

For example, if you spend $ 39,000 to earn 1000 customers, your CAC is $ 39.

CAC = ($ 39,000 spent) / (1000 customers) = $ 39 per queue

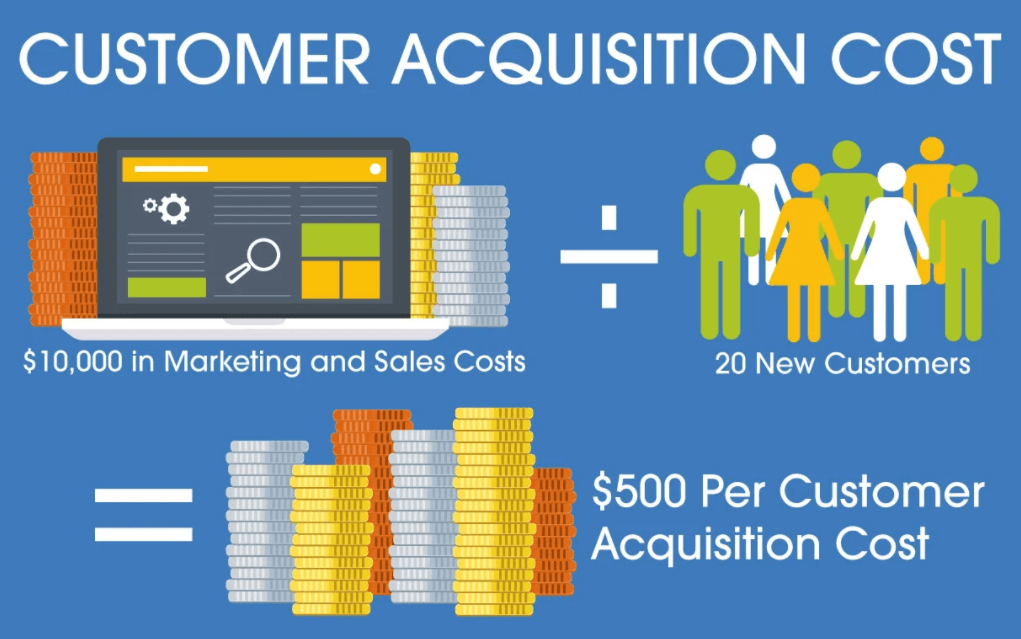

How is customer acquisition cost calculated?

Briefly, to calculate the CAC, you add the costs associated with earning new customers (the amount you spent on online marketing and sales) and then divide that amount by the number of customers you receive. It is usually charged for a specific period of time such as one year or fiscal quarter.

If a company spends $ 1,000 on marketing in a year and gains 1,000 new customers, the CAC becomes $ 1 because dividing $ 1,000 by 1,000 customers equals $ 1 to $ 1 customer.

On the other hand, if the company brings in 500 customers, their CAC will be doubled or $ 2, because they spent the same amount and brought in half new customers.

The formula is simple, but adding up the total cost can take into account many factors, including the cost of multiple marketing strategies and employee salaries.

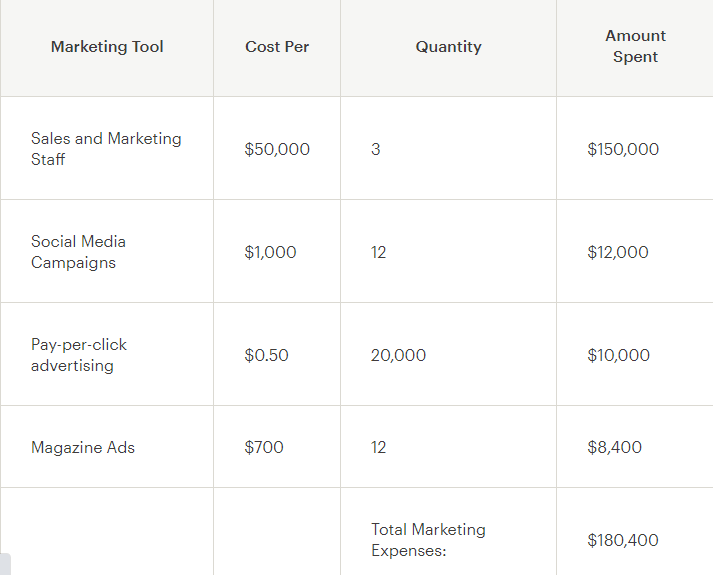

Example: Custom furniture manufacturers

Natural Seats, a virtual furniture maker, uses sustainable resources to create custom furniture. Marketing efforts for natural seats:

- Paid sales and marketing staff

- Social media campaign

- Notice of pay per click

- The quarterly-page magazine advertisements in the magazine are read by its target market

As their financial year coincides with the start and end of the year, the company has decided to keep track of how much it will cost to acquire new customers from January 1st to the end of December 31st. The process of natural seats is very simple: they take into account how much they will spend in total by December 31st and how many new customers they have.

According to Natural Seat calculations, the average cost per new customer acquired during the fiscal year was $ 71.82.

While this is a lot worse for most companies, it is a much better number for natural seats. Custom furniture comes at a price and customers expect to pay a premium for sustainable products. Natural seats are a less expensive item, a custom dining chair, priced at $ 250. So even if each customer buys only one item and it is the least expensive offer of Natural Seats, they still receive a good gross profit of $ 178.18 after their CAC.

However, this is only the basic of the CAC - you should also consider how much each customer will spend calculated using the customer’s lifetime value.

Significance of Customer Acquisition Cost (CAC)

CAC is a key business metric that many businesses and investors see. In fact, many companies fail because they do not fully understand their customer acquisition costs.

1. Improving return on investment

To evaluate marketing returns on investment it is important to understand the cost of gaining new customers. For example, consider a company that uses multiple channels to gain customers:

By using CAC, a company can determine the most cost-effective way to gain customers. In the table above, we can see that while social events have the highest price, social media offers the lowest purchase price. The company that provided this data may consider making greater use of social media marketing to generate more customers.

2. Improving profitability and profit margins

Understanding its CAC thoroughly analyzes the cost to a customer of a business and improves its profit margin. For example, suppose the value per customer for a business is $ 60.

In relation to the example above, which channel would you like to use? Businesses that do not understand CAC can negatively affect profitability by choosing to use social events as a channel. Channel social media and posters improve the profitability of the company because the CAC costs less than the customer.

Customer acquisition cost Frequently Asked Questions

What is the cost of customer acquisition?

CAC is the cost of convincing a potential customer to purchase a product or service.

What costs are included in the total customer acquisition cost?

Advertising, employee and contractor salaries, equipment, inventory management, and other sales and marketing strategies are all part of CAC.

How can I calculate the customer acquisition price?

Take your total cost to gain customers over a period of time and divide by the number of customers you gain at the same time.

How can I improve customer acquisition costs?

Things to improve: On-site conversions, customer value, and improved customer relationship management processes, and tools. Learn about conversion rate.

Conclusion

Measuring and tracking customer acquisition costs is important for investors and your company.

Investors can use CAC to determine if they think your company is profitable.

Businesses can use it to allocate resources and funds, strategize marketing campaigns and guide them in their hiring and payroll process.

To help you identify the factors that need to be included in your CAC calculation, or for other digital marketing guidance, we are here to help.

Hope! you find this information useful. if so don’t forget to share and leave comments. Thank You.

1 Comment

Leanna Holdgrafer

Spot on with this write-up, I truly believe that this site needs a lot more attention. I’ll probably be back again to see more, thanks for the advice!